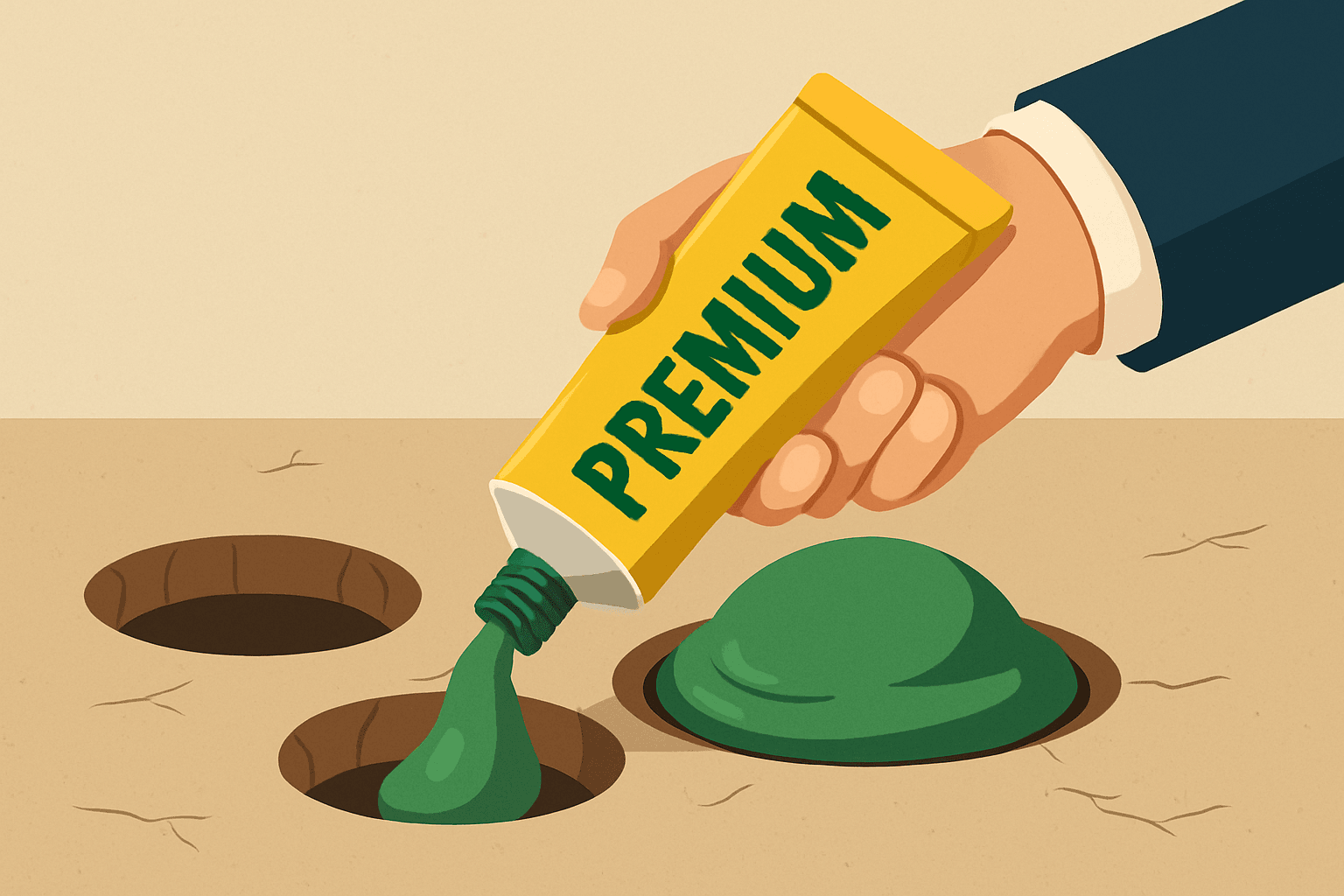

There is an old adage in the world of Risk Transfer:

When Underwriters find holes in your data at renewal, they fill them with premium!

For insurance buyers, the message is simple: data is key — be ready to show your work.

In today’s insurance market, underwriters are more cautious, more selective, and more demanding. In 2025, we’ve seen a clear shift: insurers want more data, deeper insights, and stronger evidence of proactive risk management before they’ll offer competitive premiums.

What’s Driving the Shift?

Underwriters are facing rising claims costs, increasing regulatory expectations (take a look at CPS 230 just released this week by APRA), and tougher capital requirements from reinsurers.

As a result, they’re under pressure to:

- Reduce uncertainty in pricing

- Understand the true nature of the risks they’re underwriting

- Avoid surprises in claims performance

They’re turning to data – and lots of it.

What Underwriters Want in 2025

Here’s what’s now expected during renewals and new placements:

- A full risk profile that’s structured and complete including professional and up to date risk surveys.

- Claims history with context and root cause analysis

- Evidence of internal controls, risk mitigation, and continuity planning

- Transparency on third-party exposures and cyber risks

Why Timely & Accurate Data = Better Pricing

When insurers have confidence in your data, you’re more likely to:

- Receive broader cover

- Attract multiple quotes giving you the ability to create some competitive tension

- Avoid worst-case pricing assumptions

- Negotiate from a position of strength

Well-organised risk information is no longer optional — it’s the difference between getting the best deal or being penalised.

How ReSure Can Help

At ReSure, we help organisations control and structure their own insurance data — not just for compliance, but to gain an edge at renewal. Our SaaS platform enables clients to:

- Build and maintain a clear risk profile with up-to-date data

- Centralise and analyse all historical data, especially claims

- Use claims data to track and trace risk management improvements across the organisation and develop a risk management culture evidencing continuous improvement through focused loss control

- Provide underwriters with real-time, auditable information from a secure data base not the moving target of a spreadsheet

- Eliminate data gaps that lead to adverse pricing

Whether you’re working through a broker or direct to insurer, presenting credible, complete data is key to improving your position in the market.

Final Thoughts

As insurers become more selective, companies that own their risk narrative will win. If you want better quotes, broader coverage, and more insurer interest, start by investing in better data control and over time build a solid historical moat.

Want to learn more about how ReSure can strengthen your insurance program?

Contact us today to book a demo and see the platform in action.

ReSure – Powering Better Premium Outcomes